September 14, 2023

- 48% of UK professional investors are optimistic compared to 42% in the US

- More Americans (47%) believe global macroeconomic shocks will have a bigger impact on markets over 12 months, while most Brits (43%) believe shocks’ impact will be lesser

- The young are far more optimistic than the older age groups

Fulcrum Asset Management (Fulcrum) has released new research¹ comparing views from professional investors on both sides of the Atlantic on the macroeconomic outlook and how these views play into investment decisions.

The researchers surveyed a panel of Independent Financial Adviser (IFAs), wealth managers and institutional investors in the UK and Registered Investment Advisors (RIAs), and other financial advisers and wealth managers in the US.

The results show some disparity, suggesting that UK investors are more optimistic (48% optimistic) about the investment outlook than the North American cohort (42% optimistic); with those identifying as ‘pessimistic’ numbered at 40% in the UK and 46% in the US.

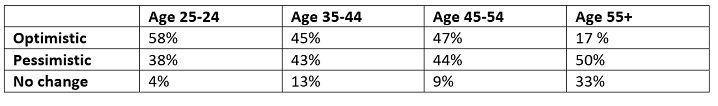

Breaking down the data further, there are some stark differences among the different age groups. When looking across both jurisdictions, of the 25-34 age group, 58% of respondents were optimistic about the next 12 months, compared with just 17% amongst the 55+ age category. Indeed, pessimism appears to increase with age.

Question: “How do you currently feel about the overall investment outlook for the next 12 months?” by age, across both the UK and US

When it came to global macroeconomic shocks and their impact on markets over the next 12 months compared with the previous 12, the US cohort was once again a lot more negative than their UK counterparts with nearly half, 47%, saying that they expected shocks to have a greater impact on markets during the next 12 months against only 37% of Brits. In the UK, most respondents (43%) thought the impact would be lesser, whereas in the US this number was 36%.

Commenting on the results, Joe Davidson, Managing Partner, Fulcrum Asset Management, said:

“After the volatility experienced in recent years, it is not surprising that there is no blanket optimism from respondents on either side of the Pond. It’s interesting to note that the exuberance of youth seems to be a real thing, with a positive attitude prevailing.

“Things can of course change quickly and the need for a disciplined investment process and effective risk management is of huge importance given today’s unstable environment.”