As at 13 November 2023

The year 2022 saw a sequence of contractionary shocks hit the global economy. Initially, these took the form of destabilising supply disruptions across global energy and agricultural markets induced by Russia’s invasion of Ukraine. Alongside this, the Federal Reserve, joined by most other major central banks, embarked on the fastest pace of interest-rate hikes since the 1980s. Given this backdrop, at the beginning of 2023 economists saw a 61% chance of an impending US recession.¹

At Fulcrum, to gauge the near-term health of the US economy, we rely on a Bayesian Dynamic Factor Model. This model uses state-of-the-art methods to arrive at a near real-time assessment of economic activity, and several of its key features were incorporated in the New York Fed’s revamped nowcasting model.

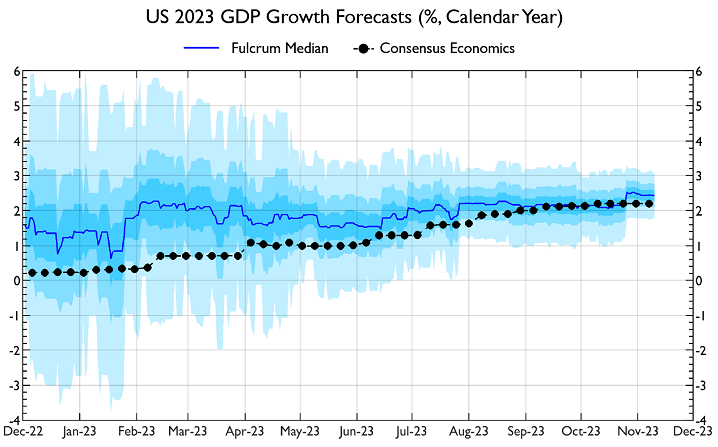

SOURCE: Fulcrum Asset Management, Consensus Economics

Note: The thick blue line represents Fulcrum’s median projection for 2023 calendar year growth over time, whilst the dark, lighter, and light blue shaded areas show the 68%, 90% and 95% confidence intervals, respectively. The black dot shows the median projection from Consensus Economics.

The figure above shows the projections for 2023 calendar year growth produced by our model, alongside the median consensus estimate of a broad range of economists. The latest projections are similar, both in the 2-2.5% range, which is to be expected given that we now have three quarters of official GDP data for 2023. What is more interesting is how these forecasts have evolved: at the start of the year, we were projecting growth around 1.5%, and after strong employment, retail sales and business surveys data, this jumped to above 2% in February and has been almost unchanged since. In contrast, the median consensus moved gradually but significantly higher, starting the year at 0% and ending above 2%.

As discussed above, going into 2023 economists had sound reasons to believe that the economy could slow or even contract outright. Importantly, however, the transmission mechanisms of shocks to the wider economy are highly uncertain, and new shocks are constantly occurring. As such, we prefer to rely on a data-rich model that incorporates the latest economic releases as they arrive. This approach proved its worth in 2023 and will remain a critical tool for our economists and portfolio managers going forward.