As at 13 November 2023

Author: Gavyn Davies, Executive Chairman

Main Points:

- Global asset markets have been heavily influenced in recent weeks by four important public statements by Fed Chair Jerome Powell, spanning the interval between the Federal Open Market Committee (FOMC) meeting on 20 September and his International Monetary Fund Panel appearance on 9 November. Details of the Chair’s guidance regarding policy have not remained consistent during this period and this has probably resulted in an increase in near-term volatility in asset prices, rather than the opposite.

- Having said that, Powell’s main theme has remained that the FOMC is considering whether monetary policy is sufficiently restrictive to bring inflation down to 2 percent over time, and on 9 November he added that “we are not confident that we have achieved such a stance”. At no point has he suggested that there is any likelihood that the Committee will contemplate a reduction in policy rates soon, so the overall bias in his remarks remains hawkish, though he has continued to emphasize that the Committee will “move carefully”. There seems little danger that the policy rate will rise at the December Fed meeting.

- With the Fed still having a clear bias against any easing in policy until inflation is clearly on a downward path towards 2% – which is not the case for core inflation at present – there remains a risk of policy overkill, leading to a hard landing. This is why there is such interest from investors in models that attempt to assess near-term recession risks. Many such models, including the (in)famous yield curve model, have repeatedly issued premature warnings of imminent US recession over the course of this year.

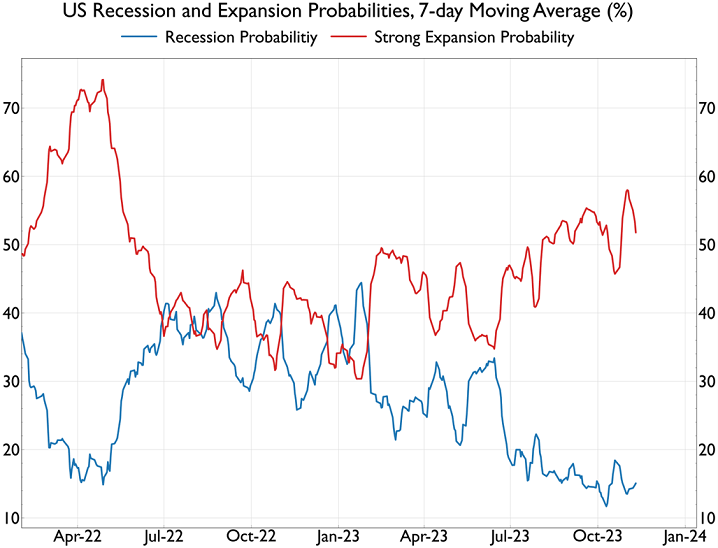

- At Fulcrum, we continue to place a great deal of weight on our nowcast models, which we would claim are best-in-class. These were estimated by Juan Antolin-Diaz about a decade ago, and they continue to provide part of the academic and practical foundation for many subsequent models in the markets and central banks. Currently the recession risk over the next 12 months in the Fulcrum model is shown to be 16%. This is up from a very temporary low point of 8% in August but is not above the broad sideways range that has been in place throughout the summer.

- Of course, the nowcast model can be wrong in any given cycle, so we pay attention to many other sources, including the so-called Sahm Rule that is widely followed in the markets. This rule is on the point of triggering a recession signal, but we would regard this as an amber sign, not a red light. It seems that Claudia Sahm agrees with this view.

- In summary, recession triggers have not yet been breached either in the Fulcrum nowcast model or in different versions of the Sahm rule. However, both Fulcrum and Sahm models are much closer to critical levels than they were in 2023 Q3. Our confidence in ruling out an imminent recession, which has been very high, has accordingly dropped slightly.

Fulcrum Recession Model and the Sahm Rule

The slowdown in US activity in recent weeks is not unexpected but it makes it more difficult to distinguish between two scenarios:

a) A benign shift in the economy, away from “no landing” and towards a soft landing; versus

b) The onset of a recession.

These two very different scenarios are observationally equivalent right now. How can we distinguish between them?

The Fulcrum nowcast model would be our preferred way of approaching this problem since it is specifically designed to estimate the current growth rate and the volatility of economic activity. This enables us to measure recession risk (in the next 12 months) on a real time basis (see Graph 1). The latest probability of a recession is estimated to be 16%, up from a (very) temporary low point of 8% in August. Although slightly higher than the low point, the estimated probability of recession has not broken above the range that has been in place throughout the summer. Having said that, there has been a noticeable fall in the activity growth rate itself in the nowcast. This dropped to 1.6% last week, about a percentage point lower than shown at the end of October.

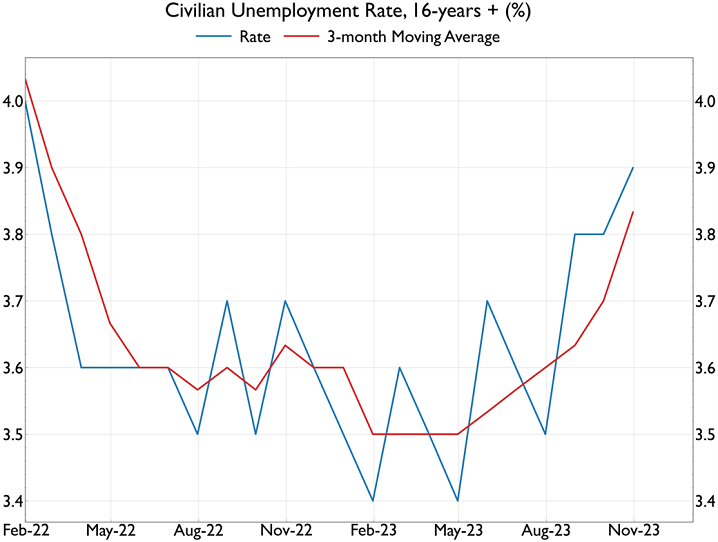

The Sahm Rule is another way of approaching this problem. Based on the work of Claudia Sahm, the rule sets a threshold for the recent rise in unemployment which in the past has signalled an imminent recession.

Her particular version of the rule says that a recession has started when the 3-month moving average for the unemployment rate (3MMA) exceeds by 0.5 percentage points the low point in the 3MMA over the past 12 months. The latest unemployment rate (3.9% in October) produces a 3MMA of 3.8%, which is 0.33 pp (unrounded) above the threshold of 3.5% reached in April. In order to exceed the threshold, the rate would need to rise to 4.3% next month or be sustained above 4% for several months to come (see Graph 2).

How reliable is this rule? A slightly different version was first popularised not by Claudia Sahm but by Bill Dudley in the 1990s, and it has worked well out of sample since then.

However, Claudia Sahm herself has suggested that the recent behaviour of the labour market may prove to be different from previous cycles. This time, the unemployment rate is rising not because of a sharp rise in layoffs but because of an unexpected rise in the labour force, due to immigration and a large rebound in the participation rate of prime age workers, notably females and Black Americans. Ms Sahm says this may result in a temporary rise in unemployment, followed by an early decline as the extra workers are absorbed into jobs. If that is the case, the rule could be breached in the current cycle without signalling a recession.

In her recent blog on Substack, Ms Sahm suggested that she had “created a monster”, adding that the rule is “not a law of nature” and advised “don’t bet on it”. Nevertheless, it is receiving a great deal of attention in the markets at the moment.

If the Sahm Rule is breached in coming months, which is very likely, it should be seen as an amber, not a red, signal. This cycle is different in many ways, and the rule is overly simplified in my view, and offers fake precision. However, if any future rise in unemployment is driven by layoffs instead of labour force growth, the signal would probably be a much darker shade of amber. This aspect of the data needs to be watched carefully in coming months.

Morgan Stanley’s economics team has suggested that a Sahm-type rule should be expressed not by reference to the unemployment rate but by reference to the employment-to-population rate. These concepts both measure slack in the labour market and are usually very closely (and negatively) correlated to each other. However, if the labour market slackens because of a rise in the labour force, the unemployment rate would rise while the employment rate would not fall very much, if at all. Therefore, the latter concept might avoid the danger of a misleading signal on a Sahm-type rule. This is indeed suggested in recent data, and we will be monitoring monthly developments in this series going forward, in parallel with the simple Sahm rule.

In conclusion, recession triggers have not yet been breached either in the Fulcrum nowcast model or in different versions of the Sahm rule. However, both Fulcrum and Sahm models are much closer to critical levels than they were in 2023 Q3, so my own confidence in ruling out an imminent recession, which has been very high, has accordingly dropped a bit.

Graph 1: Fulcrum Recession Model

Source: Fulcrum Asset Management

Graph 2: Trigger for the Sahm Rule

Source: Haver Analytics

Note: The recession rule is triggered when the 3MMA for unemployment (ie the red line) has risen by at least 0.5 PPts compared to its low point in the previous 12 months.