24 October 2023

Author: Gavyn Davies, Executive Chairman

Main Points

- Markets have recently been navigating significant changes in news flow, involving geopolitical risks and important developments regarding US growth and core inflation data. The performance of asset markets has placed relatively little weight so far on the possible economic effects of the Israel/Hamas conflict, which has been viewed as an unlikely, though potentially very significant, left tail risk to the main case forecast for the global economy.

- Assuming that the Middle East conflict remains contained, the key question is whether the soft-landing scenario for the US that has become the consensus built into the markets has been changed by recent data on the economy. The combination of much higher-than-expected GDP and employment growth in 2023 Q3, along with a significant setback to core services inflation, has posed new questions for the Fed and market participants this month.

- The surprisingly strong activity data in the US seems to have been driven by healthy consumer balance sheets and expansionary fiscal policy. These fundamental supports for the economy seem likely to be in place for a lengthy period, but the Gross Domestic Product (GDP) growth rate recorded in 2023Q3 greatly overstates the underlying activity rate. Furthermore, monetary conditions have clearly tightened sharply during Q3. The Fed expects to see a significant slowdown in economic activity in 2023 Q4, and the Federal Open Market Committee (FOMC) projections therefore show that a soft landing is probable, if not necessarily described as a “base case”.

- Chair Powell has now explicitly sanctioned the idea that rising bond yields have been driven by the term premium and has hinted that the shift in the shape of the yield curve may be replacing the need to raise policy rates more aggressively while the economy is strengthening. It has become clear that the FOMC is very reluctant to raise policy rates further for the foreseeable future.

- If, as the Fed expects, growth and core inflation both fall back in the remainder of 2023, then a period of stability is likely in policy rates and (probably) bond yields, and the markets would likely see this as consistent with a soft landing. This remains the most likely central case, but a continuation of recent strong economic data with firm core inflation in Q4 could quickly see the markets flip back into a “no landing” scenario. The inflation problem has not yet been decisively solved, in our view.

- We judge that the recent combination of rising geopolitical risks and higher core inflation in the US has resulted in a lower probability of a soft landing, despite the dovish language from Chair Powell on policy rates. We now see a 50% probability of a soft-landing path impacting asset markets in the next 3 months, with a 35% probability of a no landing scenario, and a 15% probability of an imminent hard landing.

US Inflation Data

For our economic models, the most surprising US news this month has been the publication of the September Consumer Price Index (CPI) release, which was disappointing for the soft-landing thesis that seems to be built into the Fed’s latest forecast. Although the monthly change in the headline CPI (0.4%) and the core CPI (0.32%) were only fractionally worse than the consensus expected, core services inflation printed at 0.6%, the highest reading since February. The “Powell core” reading (ie core services ex shelter) was also above 0.6%, though the Fed Chair does not seem very worried about the resulting interruption in declining core inflation prints (see below).

The Fulcrum economics group has been developing a new model to forecast US inflation. This model includes a sector that covers shelter inflation directly and somewhat reduces the degree of inflation persistence that is built into the inflation process. We intend this model, when finalised, to provide the basis for our “official” inflation forecasts in future.

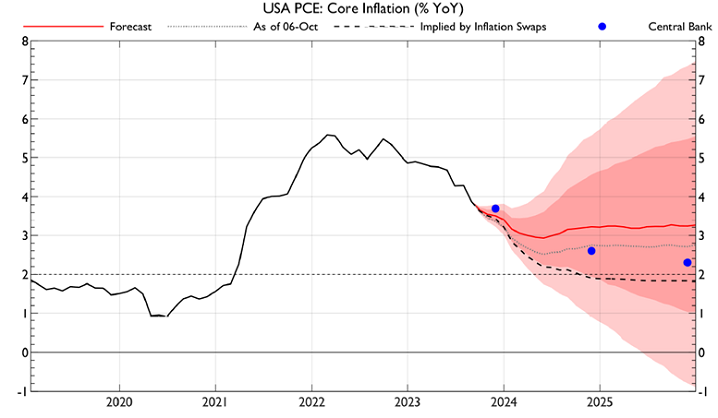

The latest forecast from this model is shown in Graph 1 below. Following the CPI and Producer Price Index (PPI) releases for September, the model predicts that core Personal Consumption Expenditures (PCE) inflation (which is probably the Fed’s main guide for policy at present) will be close to the 3.7% forecast by the FOMC at the end of 2023.

However, the model suggests that core PCE inflation will remain at about 3.2% throughout next year, which is somewhat higher than shown in the Fed’s expected path. Although the differences between Fulcrum and the Fed forecasts are not as large as they were in 2022, they do suggest that more work is needed before any significant easing in monetary policy and financial conditions can be contemplated. Many FOMC members, including the Chair, have sounded complacent about this risk in the last few days.

Fundamentals May Be Supporting Growth Outlook

Apart from the underlying trend in core inflation, the Fed is also focused on GDP growth and the labour market. They are explicitly expecting to see a slowdown in growth to below trend in 2023 Q4, producing a further easing in excess demand for labour via falling unfilled vacancy rates.

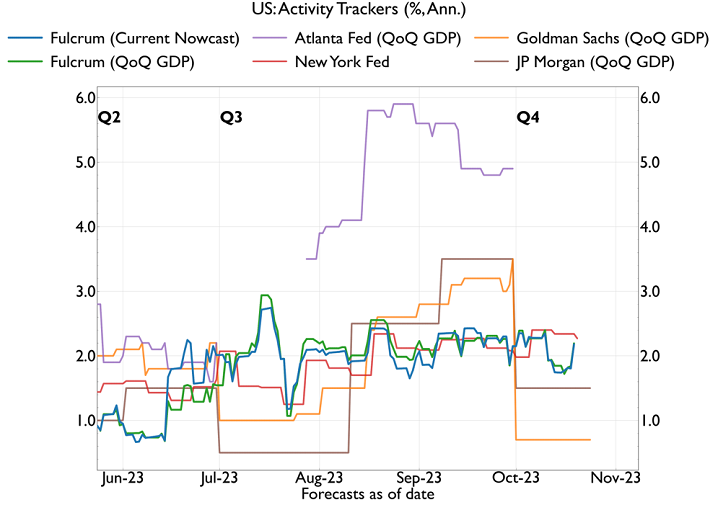

There are indeed reasons to believe a “pothole” in growth is likely in Q4, but this is not happening yet. Fulcrum nowcasts have remained slightly above trend at 2.2% while the New York Fed nowcast (using similar methods) is running at 2.3%. The Atlanta Fed nowcast, aimed specifically at predicting the advance GDP print for Q3, has recently been increased to 5.4%. While the Atlanta nowcast may be impacted by temporary variations in GDP components in the calendar quarter, it has become increasingly influential among investors because it identified the latest acceleration in GDP growth very early in the quarter (see Graph 2).

Although the very high growth rate shown in the Atlanta Fed nowcast for Q3 does not seem to be remotely sustainable, the latest labour market data (notably nonfarm payrolls and initial unemployment claims) have also shown signs of acceleration in activity growth rates. Some FOMC members have admitted that jobs growth remains exceptionally strong and now shows little slowdown since the end of last year.

It is not entirely clear why the US economy has remained so resilient in the face of the very large tightening in monetary policy since the end of 2021. One possible reason is the stance of fiscal policy, which has remained very supportive of growth in demand. According to the Congressional Budget Office, the federal budget deficit (adjusted for the large distortions that have arisen from the reversals in policy on student debt repayments) rose from $0.9 trillion in fiscal year 2022 to $2.0 trillion in fiscal year 2023, a rise equivalent to 4.1% of GDP. Several special factors have caused this increase, including deliberate fiscal policy changes (e.g., the Inflation Reduction Act), surging debt interest payments, depressed tax receipts from capital gains and delayed income tax payments caused by natural disasters, especially in California. The overall fiscal multiplier associated with this rise in the deficit is highly uncertain and may be smaller than usual, but it is unlikely to have been zero.

The only area of the economy that has raised any concern about a slowdown since the spring is the retail sector. Weaker growth has been indicated by a slowdown in credit card spending monitored in daily data. For example, the JP Morgan daily series covering Chase card spending was flat in the retail sector in September. While the credit card series are in line with weakening equity prices in the sector, along with declining consumer confidence and pessimistic anecdotal reports from retail stores last month, these sources are not very reliable and may have been affected by rising gasoline pump prices and geopolitical events. Furthermore, the September retail sales data published last week were surprisingly firm and appear consistent with 4% annualised growth in consumers’ real expenditure in 2023 Q3.

Overall, underlying consumer and labour market fundamentals still seem fairly firm. The demand for labour is undoubtedly strong, real disposable income is now growing again, house prices are rising, consumer wealth is supportive of a lower savings ratio and estimates of the available “cushion” from excess savings after the pandemic have recently been revised sharply upwards. Against this background, the gradual contractionary impulse coming from rising interest rates does not yet seem powerful enough to cause a consumer recession.

Powell Changes His Tune

There has been a clear change in important aspects of Jerome Powell’s thinking between the FOMC press conference on 20 September and his New York Economic Club (NYEC) appearance on 19 October. Between these two events, US economic data might have been expected to shift Powell’s view in a more hawkish direction for policy rates, as noted above. However, Powell reacted to these economic developments in a surprisingly benign manner last week.

Firmer growth was described as desirable by the Chair and in line with the Fed’s objective for the economy. Powell believes that stronger demand has been backed by a definite improvement in the supply side of the economy, involving the labour market and supply chains. Overall, this combination of shocks is not seen by him as inflationary, and he specifically said that wage inflation is moving downwards in a way that will soon be compatible with a return to the 2% target for price inflation. More controversially, Powell reacted to the latest CPI print in a very sanguine manner, saying:

“The September inflation data continued the downward trend but were somewhat less encouraging. Shorter-term measures of core inflation over the most recent three and six months are now running below 3 percent”.

Comparing the FOMC and NYEC texts, there was no obvious smoking gun that conclusively proves that the overall need for monetary tightening is now viewed more dovishly than before. At the FOMC, Powell said that further tightening “may” be warranted and added that “we are prepared to raise rates further if appropriate”. At the NYEC a month later he said that “additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.” Some Fed watchers appear to think that last week’s language is more nuanced on further tightening, and is subject to specific additional evidence coming in, but there does not seem to be a large difference.

So where is the clear change in Powell’s thinking? It relates to two areas: financial conditions and geopolitics. The former is far clearer than the latter.

Financial conditions…

Remarkably, there was barely any mention of financial conditions or even rising bond yields at the FOMC a month ago. Instead, Powell focused on the fact that firmer economic growth had raised the forecast path for policy rates (in line with his usual mantra of “high for longer” rates) and speculated that r* (the long-run equilibrium interest rate) may have increased. Last week, in contrast, Powell seemed very eager to discuss the impact of higher bond yields and tighter financial conditions on the possible setting of policy rates. He chose to highlight the following:

“Financial conditions have tightened significantly in recent months, and longer-term bond yields have been an important driving factor in this tightening. We remain attentive to these developments because persistent changes in financial conditions can have implications for the path of monetary policy.”

Powell has mentioned financial conditions on many previous occasions, but this latest statement is an extremely clear hint that the tightening in conditions in the past few months may be seen as a substitute for policy rate increases going forward. Of course, these tighter conditions would need to be persistent, not transitory.

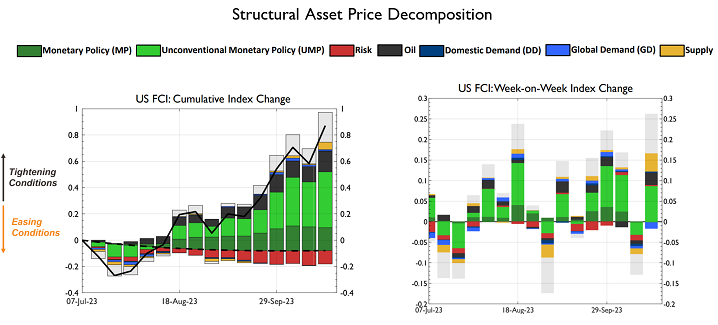

Powell twice referred explicitly to financial conditions “indexes”, not just to “conditions” as a vague concept. The Goldman Sachs Financial Conditions Index (GS FCI), which is widely followed in the markets, has tightened by 1.2 index points since last July, taking its level back to its previous peak reached late in 2022. Fulcrum’s asset price “shock” models attribute this tightening in the GS FCI mainly to unconventional monetary policy and therefore to higher bond yields (see Graph 3).

Since Powell now emphasises the rise in bond yields as the main driving force, it is important to know what he thinks is causing higher yields. Here he is quite specific. He believes the term premium is the main factor, not rising expectations of short rates, and not linked to any rise in inflation expectations.

In this interpretation, he is fully in line with influential recent speeches by Lorie Logan (Dallas Fed) and Philip Jefferson (Fed Vice Chair). This is important because he believes that a rise in the term premium can be viewed as a tightening in financial conditions that is not endogenous to economic developments, such as a rise in GDP growth. It therefore does not need to be validated by the delivery of higher policy rates by the Fed; in fact, it substitutes for this requirement.

Geopolitics…

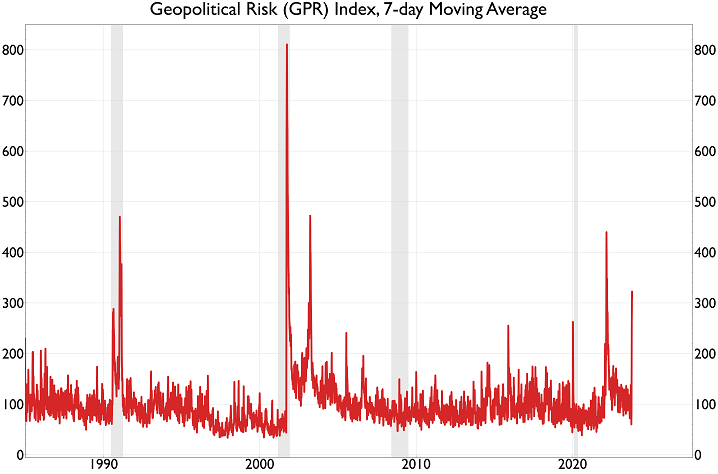

The other possible reason for a change in Powell’s language is the outbreak of conflict between Israel and Hamas, leading to concerns about a broadening of hostilities in the Middle East. At the time of this writing, the increase in geopolitical risk, as measured by the Geopolitical Risk (GPR) index that originated from economists within the Fed system, seems to have been considerable. The 7-day moving average for this index has recorded one of its largest spikes since 2003, and the current risk level is almost two-thirds of that seen in the worst period of the Ukraine War last year.

Chair Powell issued a specific warning about geopolitical risks in his appearance at the New York Economic Club, focusing on downside risks to activity, rather than on upside risks to oil prices and inflation. This suggests that he would initially see a broadening of the conflict as a reason to ease monetary policy.

However, the Financial Stability Report published by the Federal Reserve on 20 October took a somewhat different view. The Report argued that

“Escalation of these conflicts or a worsening in other geopolitical tensions could reduce economic activity and boost inflation worldwide, particularly in the event of prolonged disruptions to supply chains and interruptions in production.”

Note that this would represent a combination of adverse supply shocks to the global economy (damaging both activity and inflation) and risk shocks to asset markets. It is hard to imagine a worse scenario for the Fed or for risk assets, since it would resemble the combination of shocks that arose in the first half of 2022, albeit on a smaller scale. While we still believe that the possible result – a global hard landing – remains a tail risk, rather than the main case, it is a tail risk that has become significantly less remote in recent weeks.

Graph 1: US Core PCE Inflation Forecast to Remain Above Fed Expectations

Source: Fulcrum Asset Management, Haver Analytics

Note: As of 24th October 2023. The light and dark red shaded areas represent the 90% and 68% confidence intervals, respectively, for the inflation forecast.

Graph 2: No Sign Yet of a GDP Pothole in the Nowcasts

Source: Fulcrum Asset Management, Atlanta Fed, New York Fed, Goldman Sachs, JP Morgan

Note: As of 24th October 2023.

Graph 3: Tighter Financial Conditions Driven by Unconventional Monetary Policy and Oil Prices

Source: Fulcrum Asset Management

Note: As of 24th October 2023. The grey bar represents the unexplained residual from the model.

Graph 4: Geopolitical Risk Spikes to Two-Thirds of Peak Level in Ukraine War

Source: Dario Caldara and Matteo Iacoviello

Note: As of 24th October 2023. The grey shaded areas represent US recessions.